Have you ever wondered how your credit score is calculated?

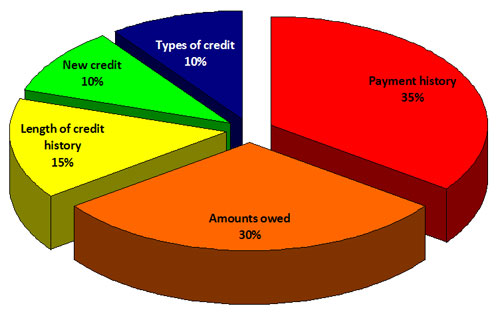

Credit scoring models use the following information when evaluating a score:

- Of the score, 35% comes from the payment history with higher weight for recent history. If late payments, collections, and/or a bankruptcy appear in the credit report, they are subtracted from the score.

- Outstanding debt is very close in importance to payment history — 30% of the total score. Many scoring models evaluate the amount of debt compared with the credit limits. If the amount owed is close to the credit limit, it affects the score negatively.

- Of the score, 15% is the result of credit history. A long history is better if payments are always on time.

- The score assigns 10% to very recent history and “inquiries” for new credit. If the applicant has applied for credit in many places recently, it will negatively affect the score. For example, this problem occurs when a person goes car shopping. Sales associates at each car lot will ask for the consumer’s Social Security number in order to pull a credit report (at “no charge”). The shopper has no idea that as more reports are ordered, the shopper’s credit rating declines.

- Finally, 10% comes from the mix of credit, including car loans, credit cards, and mortgages. Too many credit cards will hurt a person’s credit score. In some models, loans from finance companies or title loan companies will also hurt the score.

To improve a credit score, persons should pay bills on time, pay down outstanding balances, and not take on new debt. It may take a long time to improve the score significantly.